Business Mobile Banking

Deposits can be made quickly and securely. Follow these simple steps:

- Endorse the back of your check, and include the words “Cornerstone Mobile Deposit.”

- Login to mobile banking.

- Select the deposit tab and new deposit.

- Select the account to deposit funds and enter the deposit amount of the check.

- Take a photo of the front and back of the check. Take the photo against a background that gives a strong contrast, remove any objects that show up in the picture, ensure the entire check is visible, in focus and well lit (see below for additional guidelines for taking photos).

- Confirm the deposit amount.

- Result screen will indicate either Deposit Pending or Deposit Failed. If the deposit failed, you will receive an error message with the reason the deposit failed. Depending on the reason the deposit failed, you may be given an option to retake the image (see below for Guidelines for Resolving Error Message or Exception Message).

- View Deposit History to check the status of your deposit. Statuses include pending, failed and accepted.

- Retain the original Paper Item in a secure location for fourteen (14) calendar days after the deposit is credited to your account. After you have verified this, you are required to shred the check.

Mobile Deposit allows you to deposit most checks drawn on U. S. financial institutions. Checks must always be made payable to an account owner, endorsed properly and may not be made payable to a business. Certain items are not supported through Mobile Deposit and must be deposited at a bank location (see below for a list of checks that can not be deposited through Mobile Deposit).

- International Checks

- Savings bonds

- Money orders

- Third Party Checks

If you transmit your mobile deposit before 4:30 pm CST on any Business Day, we shall review and process your mobile deposit on that Business Day. If your deposit is in compliance with the mobile deposit terms and conditions and we accept the deposit, it will be credited to your account the same business day. If you transmit your mobile deposit after 4:30 pm CST on any Business Day, we shall review and process your mobile deposit on the next Business Day. If your deposit is in compliance with the mobile deposit terms and conditions and we accept the deposit, it will be credited to your account the next business day.

No. Cornerstone Bank Mobile Deposit feature is free.

Business Mobile Banking (AKA Business Mobiliti) is a mobile banking tool with powerful features for businesses of all sizes, built into a smartphone app. It integrates seamlessly with Business Online Banking and is the ultimate mobile banking app to keep account holders’ businesses moving whenever they’re on the go.

Anyone with a business account, loan, or line of credit. However, the account holder must first be enrolled in Business Online Banking before being able to use the app. Additional users must be authorized before being allowed to approve transactions, make deposits, and/or transfer funds.

Account holders with an Apple® or Android® smartphone with internet access can download our Business Mobile Banking app right from their app store. For questions on if your device is compatible, please reach out to our Cash Management team at 701-499-6768. Data and/or access fees may apply from their mobile or internet service providers.

Account holders use the same User ID and password they use for Online Banking access. After initial login, a user can also take advantage of their smartphone’s built-in security features, such as fingerprint ID and facial recognition.

Business Mobile Banking also supports the use of both hardware and software tokens, which provides an extra layer of security for our business account holders who have this feature enabled in Business Online Banking.

The powerful security features of Business Mobile Banking allow authorized users to establish controls and alerts designed to detect and stop fraudulent transactions before they happen. It protects against account takeover by safeguarding the approval process for ACH, wire transfers, account transfers, positive pay transactions, and more.

Yes. You are able to pay bills through Online Banking through your PC and Mobile device.

No, Cornerstone Bank offers Personal and Business Mobile Banking free of charge for all Online Banking customers.

Every mobile service carrier has a different rate plan for text messaging and data service access. You may be charged per use or pay a flat rate for unlimited usage each month. You may also have different fees for text messaging and data services access. Contact your mobile carrier directly if you are not sure what fees you are charged for text messaging.

Yes! In conjunction with real-time account alerts, Mobile Banking users can customize their notifications on their smartphone about the types of transactions they deem most important, such as when deposits are made, checks clear, withdrawals post to the account, and so much more. Users can set up and manage these alerts right from the app.

A short code is a shorter version of a phone number. Generally, 5-6 numbers in length. You can send and receive text messages from a standard U.S. short code as well as a traditional phone number.

Cornerstone Bank’s Business Mobile Banking registered short code is 41952. You receive all Mobile Banking text messages from this number.

You can review transaction history for the past 60 days. If you would like to see more transaction history, you can view in Online Banking.

Mobile Deposit is best suited for businesses that occasionally have checks to deposit. For businesses with more frequent checks to deposit, we recommend our Remote Deposit product, which features a dedicated desktop check scanner.

If you get locked out or forget your password in Business Mobile Banking, you can reset your password by calling 701-499-6867.

Credit Sense

Credit Sense is a Credit Score program offered by Cornerstone Bank that helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score. With this program, you always know where you stand with your credit and how Cornerstone Bank can help you reach your financial goals.

Credit Sense also monitors your credit report daily and informs you by email if there are any big changes detected such as: a new account being opened, change in address or employment, a delinquency has been reported or an injury has been made. Monitoring helps users keep an eye out for identity theft.

Getting Started with Credit Sense

- Once you’ve logged in to the Mobile App or Online Banking, tap My Credit Score

- Click Get Started

- Complete your credit profile and accept the terms and conditions to enroll in Credit Sense

- After you’ve registered, you’ll be able to view your credit score, learn about factors to help improve your score, explore savings opportunities, and sign up for credit monitoring alerts—anytime, anywhere.

Credit Sense Credit Report provides you all the information you would find on your credit file including a list of open loans, accounts and credit inquiries. You will also be able to see details on your payment history, credit utilization and public records that show up on your account. Like Credit Score, when you check your credit file, there will be no impact to your score.

No. Credit Sense is entirely free and no credit card information is required to register.

As long as you are a regular online banking user, your credit score will be updated every month and displayed in your online banking screen. You can click “refresh score” as frequently as every day by navigating to the detailed Credit Sense site from within online banking.

Credit Sense pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges:

- Excellent 781–850

- Good 661-780

- Fair 601-660

- Unfavorable 501-600

- Bad Below 500

No. Cornerstone Bank uses its own lending criteria for making loans.

No. Credit Sense is a free service to help you understand your credit health, how you make improvements in your score.

Credit Sense uses bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

Credit Sense can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home, car or paying for college—you have a clear picture of your credit health and can qualify for the best possible interest rate. You’ll also see other products and services Cornerstone Bank offers to help you reach your financial goals.

Credit Sense makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within their Credit Sense Credit Report. However, The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.

Based on your Credit Sense information, you may receive Cornerstone Bank offers on products that may be of interest to you. The educational articles, written by Jean Chatzky and the Credit Sense team, are designed to provide helpful tips on how you can manage credit and debt wisely.

No. Checking Credit Sense is a “soft inquiry”, which does not affect your credit score. Lenders use “hard inquiries” to make decisions about your credit worthiness when you apply for loans.

Yes. Credit Sense will monitor and send email alerts when there’s been a change to your credit profile.

If you access Credit Sense program through your online banking, you have to do nothing! Your email address will get updated automatically in Credit Sense when you update it in online banking. However, we always encourage you to inform Cornerstone Bank of any contact information updates.

Yes. Credit Sense is available for both mobile and tablet devices and is integrated inside our mobile application.

After 120 days of no activity in Online Banking Credit Sense will automatically deactivate. Customers will need to re-enroll.

Yes. In the credit report section there is a message that will say if your credit score is currently frozen.

Debit Card

- If your checks or debit card are lost or stolen, please report it immediately to Cornerstone Bank at 888-297-2100.

- To report a lost or stolen debit card after hours, please call 800-472-3272.

- Replacement cards are available at your local Cornerstone Bank.

Yes. Alerts can be set up to notify you of certain activity on your account. To setup alerts, log-in to online banking, click on Alerts in the top right corner of the screen, choose the type of alert and click on set up new alert. You will be prompted to choose a category, type of alert, which account you wish to have alerts on and whether to be notified by email or text.

- Your Debit MasterCard® comes with many benefits! To see complete information on each benefit, view the Guide to Benefits at the following links.

- To enroll in Mastercard®’s Identity Theft Protection, click here: ID Theft Protection

- Please call 1-800-MASTERCARD® (1-800-627-8372) with any benefit questions.

Should you need a replacement card in between renewals, we can take care of that for you at your local Cornerstone Bank. A small fee may apply.

To activate or change your PIN, log-in to your “CSB Personal” app and go to “Cards” at the bottom of the screen. Once there, make sure the card you’d like to change the PIN on is showing on the screen, then scroll down and click on “Set PIN”. Follow the prompts to complete the change.

Please call 800-992-3808 with any questions.

If you have MasterCard questions while traveling in the United States, please call 1-800-627-8372. If you are outside the United States, call 1-636-722-7111.

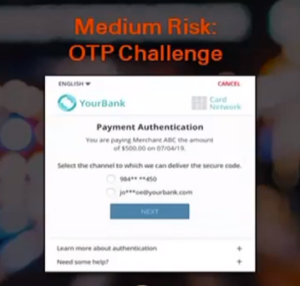

If a transaction is flagged as medium risk, you will be asked to provide a secure code. You will be given the option to choose the email or phone number we have on file as a method to receive your one time passcode. You may see a screen similar to what is shown below.

If you select to receive your code via text, the code will come from 33072 and will say something similar to, “Your auth code is #221404. It expires in 10 mins. For security, only share with agent.”

If you select to receive your code via email, the message will come from noreply@enfactnotifications.com and will say something similar to, “Your Cornerstone Bank authentication code is #519295. This code expires in 10 minutes. For your security, please don’t share it with anyone other than the agent you’re working with.”

Mobile Banking

After you login to online banking,

- Click on Options and scroll down to Mobile Banking Profile.

- Click on Manage Devices.

- If you are not enrolled, this will state Enrollment Status: Not Enrolled and you have the option to Enroll Now.

- When you choose Enroll Now, you will be taken to the Terms and Conditions to accept.

- You will then be directed to the Mobile Banking Main Menu to walk through the set up of your Mobile Banking using text, app, or mobile browser.

Yes. Using Mobile Deposit via our mobile banking app offers the same security features and protection as our online banking service, including security login, as well as a timeout feature when your mobile device is not in use. We use advanced encryption and security technology:

- When you log in with your smartphone, we confirm your credentials and device.

- Online banking credentials are not stored on your mobile device.

- Check images are not stored on your mobile device.

- We require frequent password changes.

- You can view accounts by nicknames you define, not by account numbers.

- 128-bit encryption masks your sensitive information.

In addition, please follow these best practices to secure your mobile device:

- Keep passwords, usernames and authentication information confidential and do not share them with others.

- Always remember to log off properly when you have completed your mobile banking session.

- Do not leave your mobile phone unattended.

- In the event that your mobile device is lost or stolen, your mobile banking service can be disabled by calling 888-297-2100.

- Lost or stolen phones should be reported to the carrier promptly.

- Password-protect your device.

- Always lock your device when it’s not in use.

- Set your device to automatically lock after being idle for a set amount of time.

- Set your device to use a longer and stronger password than the default 4-digit unlock code if this option is available on your phone.

- Never send personal information (account numbers, passwords, social security number, etc.) using text messaging. If a message is intercepted or your phone is stolen, it could be used in ID theft.

- To ensure the safety of your personal and account information, only download mobile apps from reputable sources (i.e. Google Play or Apple App Store).

You can use the Mobile Deposit service if:

- You are enrolled in Cornerstone Bank Personal Online Banking.

- You have downloaded the Cornerstone Bank App and enrolled in Mobile Banking.

- You have a supported iPhone or Android device.

- You are an owner on an active personal checking or savings account.

- You read and accept the Mobile Deposit Terms and Conditions.

Deposits can be made quickly and securely. Follow these simple steps:

- Endorse the back of your check, and include the words “Cornerstone Mobile Deposit.”

- Login to mobile banking.

- Select the deposit tab and new deposit.

- Select the account to deposit funds and enter the deposit amount of the check.

- Take a photo of the front and back of the check. Take the photo against a background that gives a strong contrast, remove any objects that show up in the picture, ensure the entire check is visible, in focus and well lit (see below for additional guidelines for taking photos).

- Confirm the deposit amount.

- Result screen will indicate either Deposit Pending or Deposit Failed. If the deposit failed, you will receive an error message with the reason the deposit failed. Depending on the reason the deposit failed, you may be given an option to retake the image (see below for Guidelines for Resolving Error Message or Exception Message).

- View Deposit History to check the status of your deposit. Statuses include pending, failed and accepted.

- Retain the original Paper Item in a secure location for fourteen (14) calendar days after the deposit is credited to your account. After you have verified this, you are required to shred the check.

Mobile Deposit allows you to deposit most checks drawn on U. S. financial institutions. Checks must always be made payable to an account owner, endorsed properly and may not be made payable to a business. Certain items are not supported through Mobile Deposit and must be deposited at a bank location (see below for a list of checks that can not be deposited through Mobile Deposit).

- International Checks

- Savings bonds

- Money orders

- Third Party Checks

If you receive an error message that the deposit failed, you may be given an option to retake the photo depending on the reason the deposit failed (see below for Guidelines for Resolving Error Message or Exception Message).

The bank is in the process of reviewing your deposit to ensure it is in compliance with the Mobile Deposit Terms and Conditions. The deposit will either be accepted or rejected.

The bank reviewed your mobile deposit and rejected the deposit. Please contact the bank at 888-297-2100 to determine the reason it was rejected.

If you transmit your mobile deposit before 4:30 pm CST on any Business Day, we shall review and process your mobile deposit on that Business Day. If your deposit is in compliance with the mobile deposit terms and conditions and displays “accepted”, it will be credited to your account the same business day. If you transmit your mobile deposit after 4:30 pm CST on any Business Day, we shall review and process your mobile deposit on the next Business Day. If your deposit is in compliance with the mobile deposit terms and conditions and displays “accepted”, it will be credited to your account the next business day.

There are certain conditions in the process of making a mobile deposit that may result in an error message. You may be given the option to resolve the error (see below for Guidelines for Resolving Exception or Error Messages).

If you transmit your mobile deposit before 4:30 pm CST on any Business Day, we shall review and process your mobile deposit on that Business Day. If your deposit is in compliance with the mobile deposit terms and conditions and we accept the deposit, it will be credited to your account the same business day. If you transmit your mobile deposit after 4:30 pm CST on any Business Day, we shall review and process your mobile deposit on the next Business Day. If your deposit is in compliance with the mobile deposit terms and conditions and we accept the deposit, it will be credited to your account the next business day.

Yes. Our mobile app displays the per check limit and daily allowed limit before completing a deposit. Each check is considered a separate deposit. There is no limit to the number of checks you can deposit in a day. To request a higher limit, please contact your local Cornerstone Bank.

Securely store your check for 14 days after the deposit has been credited to your account. After you have verified this, you are required to shred the check.

No. Cornerstone Bank Mobile Deposit feature is free.

No. We will use what is called a substitute (or electronic) deposit slip to post the deposit to your account.

Yes. A mobile deposit alert can be set up through online banking. After logging in to online banking, click on alerts, click on either checking or savings, click on set up new alert and choose the category and type of alert, then choose which account you would like to receive an alert for and then how you would like to be notified of the alert. You will receive an alert message the day after the mobile deposit posts to your account.

Yes. Endorse the back of your check, and include the words “Cornerstone Mobile Deposit.”

Your deposit will go through a data validation process after you confirm your deposit information. If the deposit fails during the data validation process, you will receive a message that the “Deposit Failed” and the reason the deposit failed. If the deposit fails, you may be given an option to retake the photo (see below for Guidelines to Resolve Error or Exception Message). We encourage you to check the status of your deposit within 2 hours of submitting your deposit by selecting Deposits and View Deposit History to make certain the status indicates accepted.

You can inquire on your account through Mobile Banking.

You can view the deposit history and the status of a deposit by selecting Deposits and View Deposit History section. You will be able to view 30 days of deposit history and view a check image.

There are a few reasons that checks may not be able to be deposited:

- Folded or torn corners

- Front image is not legible

- Amount entered does not match the amount read by the scanning software

- Courtesy amount is not legible

- Routing and account numbers are unclear

- No camera on the device

- Image is too dark or too light

- Check is not drawn on a U. S. financial institution

- Check already deposited

- Missing endorsement

If you have questions about Mobile Deposit, please call 888-297-2100 or email customerservice@cornerstone.bank

- When prompted for the amount, carefully enter the check amount to ensure it matches the amount written on your check.

- Flatten folded or crumpled checks before taking your photos.

- Keep the check within the view finder on the camera screen when capturing your photos.

- Try not to get too much of the areas surrounding the check.

- Take the photos of your check in a well-lit area.

- Take the photo against a background that gives a strong contrast. Place the check on solid dark background before taking the photo of it. A light colored check against a light colored background may not work.

- Keep your phone flat and steady above the check when taking your photos.

- Hold the camera as square to the check as possible to reduce corner to corner skew.

- Make sure that the entire check image is visible and in focus before submitting your deposit.

- No shadows across the check

- All four corners are visible

- Check is not blurry

- The MICR line (numbers on the bottom of your check) is readable

- Checks payable to any person other than you

- Checks payable to any person other than the person that owns the account that the check is being deposited into

- Checks drawn on a financial institution located outside the United States

- Checks not payable in United States currency

- Some check formats will not take. An example of this may be personal checks with busy backgrounds

- An image replacement document

- Remotely created checks (whether in paper form or electronically created)

- Checks drawn against a line of credit

- Checks that the image quality does not pass validation

- Duplicate Detection if the check has already been submitted for deposit

- Savings bonds

- Traveler’s checks

- Insurance drafts

- Sight drafts

- Cash

- Checks or items containing alteration to any of the fields on the front of the check or item (including the MICR line), or which you know or suspect, or should know or suspect, are fraudulent or otherwise not authorized by the owner of the account on which the check or item is drawn

- Checks that the courtesy amount is not legible

- Checks dated more than six (6) months prior to the date of deposit

The following exception messages provide certain conditions that may result in an error message and how to resolve the exception.

Condition

- The user selects Continue when an amount has not been entered

- The user selects Continue when an invalid amount has been entered

- The deposit amount exceeds the user‘s daily threshold amount for deposits

- The deposit amount exceeds the user’s threshold amount for a single item

- The image upload for either the front or back image fails

Error Message

Please enter the check amount.

Enter only numbers (dollars and cents) for the deposit amount.

You have exceeded the maximum cumulative deposit amount allowed in a day. Please contact the bank at 888-297-2100.

You have exceeded the maximum amount allowed for a single deposit. Please contact the bank at 888-297-2100.

Your image upload has failed. Please retake the photo or try again later.

Support Solution

User

User

User/Bank

User/Bank

User

This table lists errors you may encounter. The table lists the condition (what), the error you will receive and the option in the App to resolve the error.

Error Message Text

Cannot read check. Please retake the photo. Hold the camera steady and ensure all four corners are visible.

Could not find endorsement on back of check. Make sure check is endorsed and retake the photo.

This check has already been submitted. We cannot accept it again.

Poor lighting or contrast detected. Please retake the photo with good lighting.

Cannot read account data on bottom of check. Please retake the photo. Ensure the camera is in focus and all four corners are visible.

Significant rotation or angle detected. Please retake the photo. Hold phone flat above check and keep all four corners visible.

It appears you submitted 2 images of front of check. Please retake both front and rear photos.

The amount you entered did not match the amount detected. Please re-enter amount and retake photo.

Account holders use the same User ID and password they use for Online Banking access. After initial login, a user can also take advantage of their smartphone’s built-in security features, such as fingerprint ID and facial recognition.

Business Mobile Banking also supports the use of both hardware and software tokens, which provides an extra layer of security for our business account holders who have this feature enabled in Business Online Banking.

Yes. You are able to pay bills through Online Banking through your PC and Mobile device.

No, Cornerstone Bank offers Personal and Business Mobile Banking free of charge for all Online Banking customers.

Yes! In conjunction with real-time account alerts, Mobile Banking users can customize their notifications on their smartphone about the types of transactions they deem most important, such as when deposits are made, checks clear, withdrawals post to the account, and so much more. Users can set up and manage these alerts right from the app.

You can review transaction history for the past 60 days. If you would like to see more transaction history, you can view in Online Banking.

Online Banking

Once you have logged in to your online banking,

- Click Profile.

- Select Mobile Banking.

- Click manage devices.

- Click add new device and follow the prompts through an easy set up process.

You can view any checking, savings, certificate and loan account that you are an owner or signer.

No. Cornerstone Bank online banking is a free service.

It may be denied for a couple reasons. Your Username is case sensitive and must be at least 6 characters with no required numeric or alpha. The Username may already exist for another online banking client.

If you wish to change your Username, please contact the bank.

You are required to change your password annually for security purposes.

Please contact our Customer Service Team at 888-297-2100.

Click on the Forgot Password link on the home screen or on Forgot Password link where you would typically input your password. It will ask for your Username, last four digits of your social security number and email address. The email address must match the email address Cornerstone Bank has on file. Then click on reset password. You will receive a message that an email with your temporary password has been sent to the email address we have on file. You will receive an email with your temporary password. You will be prompted to change your password the first time you login.

Once you have logged in to your online banking,

- Select Profile at the top of the screen and scroll down to password and click on edit.

- You will need to enter your current and new password.

Once you have logged in to your online banking,

- Select Profile at the top of the screen and scroll down to the section titled, Challenge Questions.

- Click on Edit and follow the instructions through the drop downs to change your security questions.

Once you have logged in to your online banking,

- Select Profile at the top of the screen and scroll down to the section titled, Email.

- Click on Edit and enter your email address twice to confirm it.

After 90 days of no activity your online account will deactivate. You will need to re-enroll as a new user.

Yes. Alerts can be set up to notify you of balances or activity on your account, such as pending transactions, ACH debits and checks that have cleared. To setup alerts, click on Alerts in the top right corner of any online screen, choose the type of alert and click on set up new alert. You will be prompted to choose a category, type of alert, which account you wish to have alerts on and whether to be notified by email or text.

Many of the alerts are tied to specific transaction types (such as checks cleared, ACH debit) that require nightly processing to trigger the alert. Typically, you will receive the alert the next morning. If you have a pending transaction alert set up, you may receive notification throughout the day.

Yes. Once you have logged in to your online banking, click on categorize. You can create spending reports on all your accounts and export transactions. You can create an income and expense report. You have the ability to assign or change the category on a transaction under view transactions.

You are only able to view accounts for which you are an authorized signer. If you believe that you are an authorized signer for an account that you are unable to view, please contact our Customer Service Team at 888-297-2100.

Once you have logged in to online banking, you can view an image of a check or deposit on the home page by clicking on the account and scrolling down to the transactions and then click on the hyperlink. The front and back of all checks/deposits will be displayed. This service is free!

Since these transactions will not post to your account until the nightly update, you can not view the image until the following business day.

You may view images for the past 18 months.

Using nicknames can make it easier to manage your accounts. From the home page, click on Edit Accounts and a list of your accounts will appear. Just select the account you would like to add a nickname to and type the nickname in the box on the left hand side.

Once you have logged in to your online banking,

- Click on Pay Bills at the top of the screen.

- You will be asked to read and accept the terms and conditions.

Click on Transfer, complete each field and check the repeat box. You can choose the frequency of the transfer. If you would like to delete a scheduled transfer, please contact the bank.

The cut-off time is 6:00 pm Central Standard Time (CST). Transfers scheduled after that time will be processed the following business day.

The transaction will occur on the next business day after the weekend or holiday.

Yes. You can use the transfer option to move funds from your checking or savings account to make a regular, principal, interest, or escrow payment. If you make a regular loan payment, it will reduce your automatic payment amount.

You can view the past 18 months of statements by clicking Accounts and then Documents. Choose the account in the account drop down and enter the date range. Then click on submit.

Once you have logged in to your online banking,

- Click on Profile at the top of the screen.

- Scroll down to Electronic Statements and click Edit.

- You are allowed to enroll for electronic statements if you are listed as the first name on an account.

- Scroll to the account that you wish to enroll for electronic statements.

- Click on Checking, click on electronic statements terms and conditions and read the terms and conditions.

- Close out of the terms and conditions and you will be back on the electronic statement screen.

- Click on the box that you have read the terms and conditions and then click save.

There is no fee to receive electronic statements!

We will notify you that your electronic statements are ready for viewing at the e-mail address you provide when you enroll.

Yes, you simply need to stop in the bank or give us a call, and we can reactivate them for you. There is a $2 per month charge for paper statements. NOTE: If you are a Rewards Checking customer, remember that this is one of the qualifiers.

You are allowed to enroll for electronic statements if you are listed as the first name on an account.

Yes. We use advanced technology to ensure your information stays safe and secure. Only you have the access to your accounts with your Username and password. We strongly suggest you do not share your Username or password, PIN or account numbers with anyone. One additional way that we help you keep online banking secure is by having you change your password annually.

Make your password strong by using capital and lower case letters, numbers, and symbols.

When logging in to online banking click on the hide feature when entering your username and answering your security challenge question.

Change your password often.

During enrollment in online banking, you will be asked security questions and have the option to register the computer you are using. Do not register a public computer.

Install anti-virus and anti-malware software on your computer.

Ensure that up to date anti-virus and anti-malware software programs are being used on your computer.

Never share any personal information, especially social security numbers, account numbers, logins or passwords, especially via e-mail.

Memorize your ID and password so that you don’t have it written down or stored on your mobile device.

When you are finished using online banking, always choose to “Log Out”.

Never provide your user name or password to anyone calling you and asking for it, even if they identify themselves as being from the bank.

Yes. To authenticate your identity, you will be prompted to answer security challenge questions that you set up during enrollment in online banking. Do not register a public computer.